European solar module production is still insignificant on a global scale and dependence on China is dangerous. Germany and the EU want to change this and ramp up European production capacities. The fact that this depends on the procurement of solar glass is consistently forgotten.

Gigantic expansion of photovoltaics requires a lot of glass

The Chinese are planning holistically, because they know that solar module production is not possible without solar glass. Consequently, massive quantities of glass are needed for the gigantic expansion targets of photovoltaics. That is why the German company Grenzebach received orders from China as early as 2020 for more than 160 drawn glass lines especially for the photovoltaic market.

These have been delivered in the meantime. In Europe, there are just a handful of such lines and there are no plans to close this ever-growing gap. Germany offers the world's best melting technology with world market leaders like Sorg and Horn. France and England also have excellent suppliers.

Don‘t forget to sign up for our free webinar series GW-News Talks!

Lisec in Austria supplies the best equipment for coating and tempering technology. Almost all innovative equipment for the solar industry is delivered to China - not to Europe.

Enormous investment required

The construction of a solar glass factory requires an investment of up to 165 million euros for a production line of optimal size with a melting capacity of 500 tonnes per 24 hours. The energy consumption (80 per cent gas) and the reduction of environmental pollution (carbon dioxide and nitrogen oxides) require a considerable investment and long approval procedures. The period from planning to operation of a solar glass production plant is therefore three to four years. This is long compared to six to ten months for a new solar module production line.

Will glass become a strategic asset?

One could argue that we should just buy solar glass in China. However, the argument in favour of securing a European supply chain and saving logistics costs through European production then collapses. This would also increase the dependence on China, which is already viewed very critically.

From the Chinese point of view, it might make sense to limit the export of solar glass as soon as European solar production really takes off! This would revive Chinese module sales and the Europeans could shut down their production lines.

Glass factories among the Uyghurs

Finally, the accusation that production in China takes place under bad political and environmental conditions also weighs heavily. Several glass factories are located in the province of Xinjiang, the territory of the oppressed Uyghurs.

With a weight share of up to 80 per cent of a standard PV module, the transport of the glass is almost as cost and time intensive as the finished modules.

EU underestimates glass as a strategic component

The expansion targets for a "New European Solar Industry" are gigantic and have recently been revised upwards significantly in view of the war in Ukraine. In most cases, the expansion of production capacities is to take place along the entire value chain, from silicon to wafers and cells to module production.

[How will rising energy prices impact the glass sector?]

Strangely, one important component is always missing from this list and from the plans for gigawatt factories: The solar glass needed for 99 per cent of all modules. This indispensable component is not sufficiently available in Europe. The following arguments make this clear:

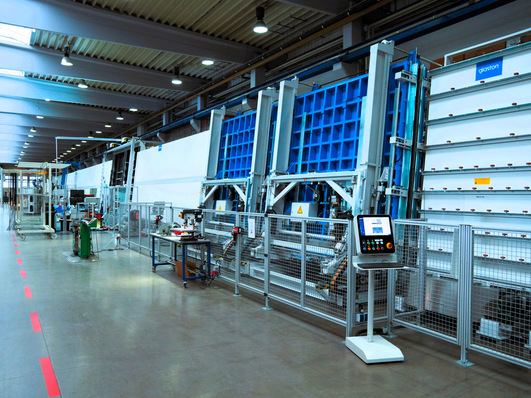

Structural glass in the rolling process

Ultra-white solar glass is mainly produced as structural glass in a rolling process. Special shaping rollers are used to increase the thickness of the glass and to form a microstructure on both sides of the glass. This keeps the reflection in the glass to a large extent and thus causes a high transmittance. The usual process of flat glass production is less suitable for solar glass.

Factory in Brandenburg sold

At present, a maximum of three to four gigawatts of solar modules can be produced with solar glass made in Europe. A nominal proportion of the glass was imported from India and a few other countries until 2021.

It is striking that the largest European solar glass supplier, Interfloat, with its production GMB Glasmanufaktur Brandenburg in Tschernitz was sold to the Indian market leader Borosil in April 2022. In view of the fact that production there depends on uninterrupted gas supplies, industry insiders were surprised. Because apart from the risk of interruption of Russian gas supplies, at today's gas prices, break-even production is only possible at almost unrealistically high selling prices for the solar glass.

Expensive cold repair ahead

Borosil was probably more interested in gaining access to the market, especially since funds of about 30 million euros will have to be raised in about three years for an expected cold repair of the melting furnace. Borosil wants to increase its production capacity to 2,600 tonnes per day by 2025. It is doubtful whether the claimed 450 tonnes will really be produced in Brandenburg. But even this amount would only be enough for about 2.5 gigawatts of solar module production.

Ten times higher demand for solar glass in Europe

The expansion targets published by the EU assume an increase in European module production of up to 30 gigawatts by 2030. Even if module efficiencies increase, this would result in almost ten times the demand for solar glass in 2030 compared to 2021. The question is how this demand will be met, as new production capacities for solar glass are not in sight.

Gas price impacts on profitability

Glass production requires a high energy input, 80 per cent of which has to be met by natural gas. Production is not flexible and the melting furnaces have to be heated around the clock, 365 days a year. At a gas price of about six euros per megawatt hour, energy accounted for about 35 per cent of production costs in 2020.

[Generating electricity from facade glass]

On 7 March, a price of 211 euros was quoted on the TTF Dutch Future spot market. Even if this peak price has come down in the meantime, no one currently expects prices below 50 to 80 euros per megawatt hour to be reached in the next few years.

Hybrid furnaces as an alternative

So-called hybrid furnaces can be considered as a possible alternative. The hybrid technology for glass production is convincing: With a maximum electric share of 80 per cent and only 20 per cent gas, up to 16 per cent energy could be saved and carbon dioxide emissions reduced by 80 per cent.

However, it must be critically noted that this melting technology has so far only been developed for container glass. An industrial plant is not yet in operation.

Reducing emissions with green electricity

Sustainable electrical energy will play an important role in the transformation of the glass industry because it has the highest energy efficiency of all energy sources. However, some processes require a certain amount of energy from gas to keep the glass melting system flexible.

Hybrid furnace technology has the potential to reduce direct furnace emissions by 60 per cent and overall plant emissions by 50 per cent by replacing 80 per cent of the natural gas with renewable electricity. The carbon dioxide reduction potential of this innovation is even higher when subsequently combined with other innovative energy sources such as hydrogen.

A European solar industry is essential

A European Commission official pointed out at the April 2022 Solar Power Summit in Brussels that solar production in Europe must be rebuilt - "whatever the cost".

However, the current support is too short-sighted and starts with the wafer. Without including solar glass as the most energy-intensive and heaviest component, dependence on China in the solar market will remain. The current estimated gap in solar glass for European manufacturing will grow from 80 per cent to 95 per cent due to expansion plans up to 30 gigawatts.

EU must act now

Nobody would think of excluding the necessary steel from the consideration in the production chain of automobiles. But that is what is happening when considering the value chain for PV modules! "Similar to the situation with Russia, the asymmetry and one-sidedness of Germany's dependence on China is a central problem," said Marcel Fratzscher, President of the German Institute of Economic Research.

[How is a float glass production without natural gas possible?]

China is increasingly using this as leverage against Germany and Europe. The dependence on Chinese components (including BOS components including inverters) is around 90 per cent.

It will increase with the expansion of module production in Europe. The EU needs an industrial policy that consistently supports the development of strategic key industries. Certainly not a policy that ignores a dependency of more than 90 percent on solar glass components in the future.